When it comes to understanding the relationship between a business and nature, among the earliest and most critical steps involves mapping its dependencies on ecosystem services – as well as its pressures on ecosystems.

What are dependencies and pressures on ecosystems?

Dependencies on ecosystem services are the ways businesses and economic activities rely on nature’s functions – such as water supply, soil fertility, pollination, climate regulation, and flood protection – to operate, produce goods, and maintain value chains. They are important because degradation of these services can disrupt operations, increase costs, create physical and transition risks, and ultimately threaten financial performance and long-term resilience.

Pressures on ecosystems, by contrast, are the direct and indirect ways economic activities degrade nature – such as land conversion, water extraction, pollution, greenhouse gas emissions, and resource overexploitation – reducing ecosystem condition and biodiversity. They matter because these pressures drive ecosystem decline, triggering regulatory, market, reputational, and physical risks that can disrupt supply chains, erode asset value, and weaken long-term economic stability.

We’ve recently launched a tool that provides a company-level analysis of dependencies and pressures under one roof.

The tool

Before diving into the tool’s capabilities, it’s helpful to provide more information on its ingredients. At GIST Impact, we bring together institutional-grade methodologies, granular data and global coverage to provide intelligence on company dependencies and pressures, worldwide.

This includes:

- The market-leading ENCORE – Exploring Natural Capital Opportunities, Risks and Exposure – framework, setting out which business activities have the most material dependencies and pressures.

- GIST Impact Business Revenue Data, which provides granular classification of a company’s revenue streams across 1,000+ business activities, as well as 285+ geographies.

- Coverage of 20,000+ companies, across all major indices.

- Data from 2016 until current year.

The tool is currently live on our portal, and the below image should give you a better idea of its component parts:

The intelligence

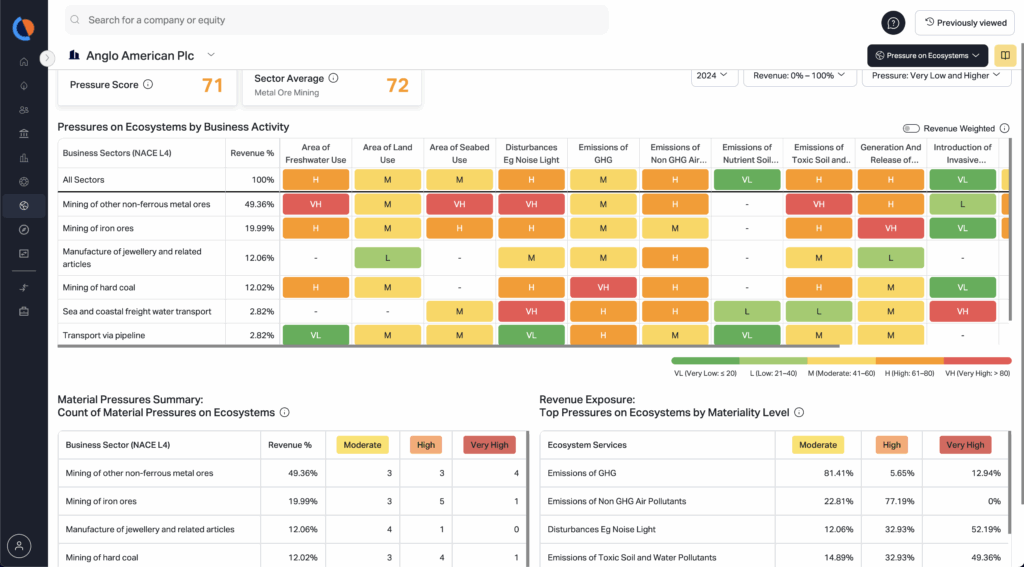

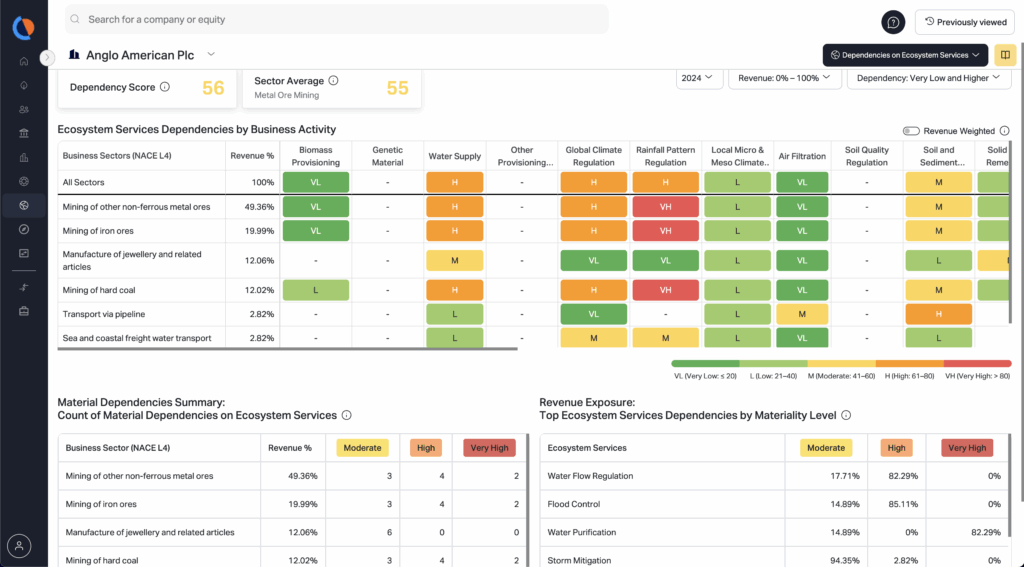

Now into the detail. The tool enables both high-level and deep-dive insights, including:

- Dependency and Pressure Scores at company and sector levels, offering an aggregated view of performance with comparison to the sector benchmark.

- A breakdown of a company’s revenue streams (down to NACE Level 4) and the relative materiality (from very high to very low) of that business activity across 25 dependencies and 13 types of pressures.

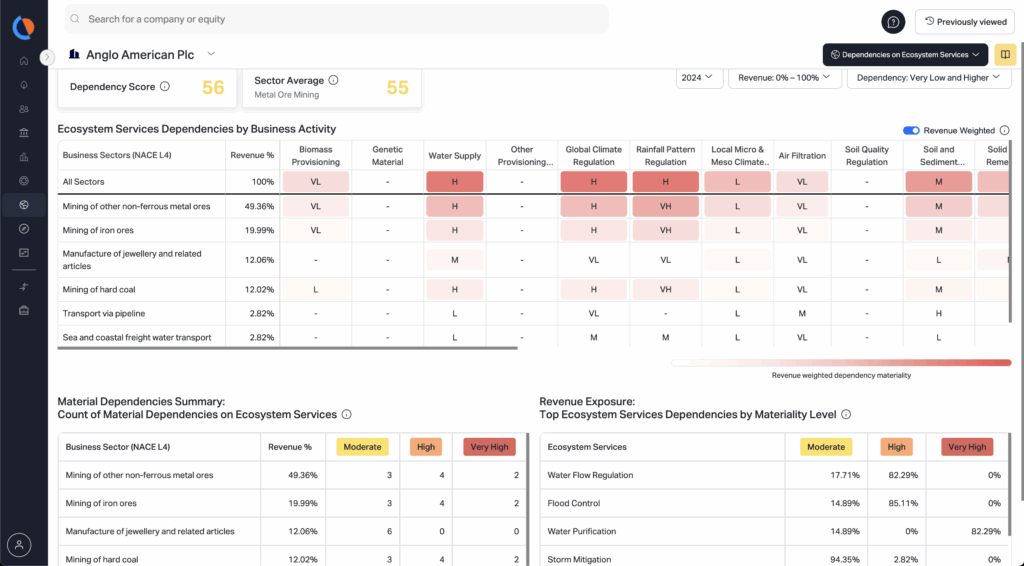

- The ability to weigh the materiality of dependencies and pressures by revenue, to take into account business activities that are financially material to the company.

- Additional insights revealing consolidated counts of material dependencies and pressures by business activity, and a summary of the revenue exposure to the top dependencies and pressures.

The next step

This dependencies and pressures tool can serve as the gateway for additional nature and biodiversity analysis at asset, company and portfolio levels – and GIST Impact empowers users to:

- Drill down to asset level – to see asset proximity to areas of biodiversity importance (such as Key Biodiversity Areas or IUCN Red List species), ecosystem integrity (such as measured via the Biodiversity Intactness Index or Mean Species Abundance), or exposure to physical risks (such as water stress or coastal/riverine flooding).

- Go beyond high-level pressures to assess specific impacts on biodiversity and society, in terms of a Potentially Disappeared Fraction of species and monetised impacts on natural capital, respectively.

- Uncover additional company-level risks – such as involvement in deforestation (via Forest IQ Pro) or production capacity shortfall arising from nature degradation, in terms of Nature Value at Risk (you’ll hear more from us about that shortly!).

—

If you’re excited to learn more about how this tool can support your work on nature and biodiversity, get in touch with out team to chat further and see it in action.