GIST Impact Launches Nature Value at Risk Dataset to Help Investors Quantify Financial Exposure to Nature Loss

LONDON, 25 February 2026 – GIST Impact today announced the launch of its new Nature Value at Risk (NVaR) dataset, designed to help financial institutions quantify how the degradation of natural capital translates into financial risk at the portfolio and company level. The launch marks a significant milestone in making nature-related financial risk actionable for […]

Decision-grade data starts with embedded traceability

In the rapidly evolving world of sustainability, we are seeing a massive influx of information. We often hear about the rising need for risk management, reporting, and stewardship, but none of these are possible without reliable data. After all, you cannot manage what you cannot measure. As the demand for information grows, so does a […]

In the News: Growing appetite for ‘financialisation’ of risk data, says GIST Impact

In a conversation with Environmental Finance this week, our VP and Head of Nature and Biodiversity Products, Dr. Thomas Moran discussed how the market for climate and nature data is evolving, with growing interest from financial institutions to understand and quantify the financial implications of nature-related risks. With portfolios facing increasing exposure to physical climate […]

Understanding how nature risk becomes financial risk

As a data and analytics provider, GIST Impact works deep in the weeds of clients’ annual reporting cycles. At the core of our work is providing the most robust, science-based data on nature and biodiversity – and guiding clients on how to use these insights and apply it to their portfolios and assets. This article […]

How It’s Done: Calculating Outside-In and Inside-Out Corporate ESG Impacts

Are you looking to to learn more about the breadth and depth of our ESG data and analytics? And do you want to see how we can help you and your clients with a holistic overview of both their outside-in and inside-out impacts? Join Jenny Frings (Head of Consulting Partnerships), Mary Hunter Hieronimus (Senior Manager […]

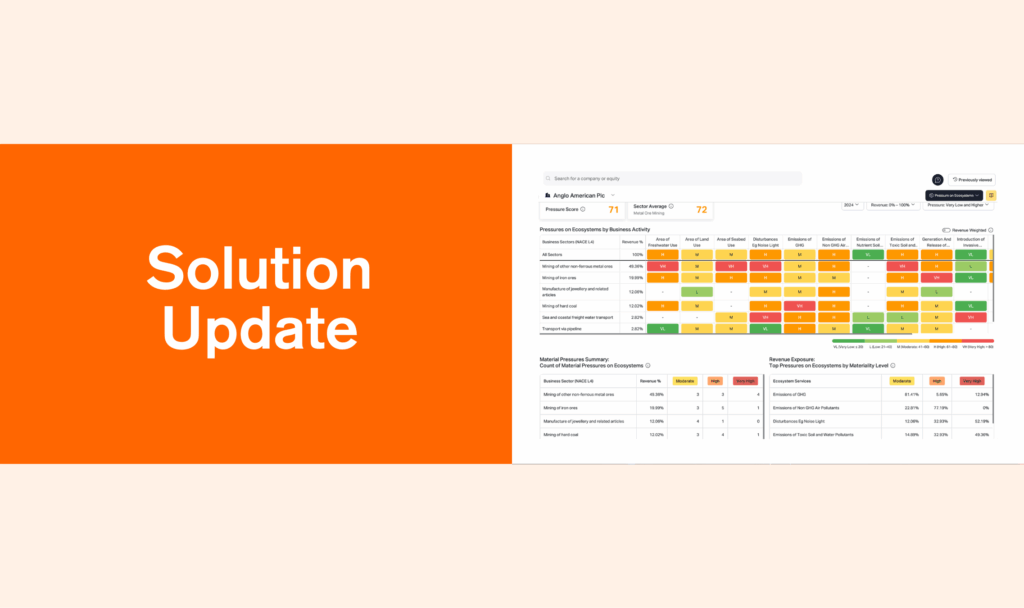

Introducing our dependencies and pressures tool

When it comes to understanding the relationship between a business and nature, among the earliest and most critical steps involves mapping its dependencies on ecosystem services – as well as its pressures on ecosystems. What are dependencies and pressures on ecosystems? Dependencies on ecosystem services are the ways businesses and economic activities rely on nature’s […]

GIST Impact partners with Green2View

GIST Impact and Green2View have announced a new partnership to help Australian organisations navigate a rapidly evolving sustainability and environmental reporting landscape and implement credible, data-driven transition strategies. As Australia moves into an era of mandatory climate and sustainability disclosures –prompted by ISSB and IFRS S2 – alongside growing expectations around nature, biodiversity, and […]

Why nuance matters when evaluating COP30

The narrative emerging from COP30 has been predictably familiar – disappointment over the absence of fossil fuel language in the final text, concerns about inadequate ambition, and questions about whether multilateral climate processes can still deliver. But for those of us on the ground in Belém, a different story emerged – one of tangible progress, […]

Turning climate risk uncertainty into actionable strategy

Discover practical lessons from corporate leaders on navigating climate uncertainty today. Climate risk is no longer a distant concern. It is already reshaping how organisations operate, make investment decisions, and manage their supply chains. Extreme weather events, the rising cost – or complete withdrawal – of insurance coverage, and tightening disclosure requirements are creating material […]

GIST Impact’s framework for forward-looking nature indicators

Financial institutions are under increasing pressure to understand how companies are managing nature-related impacts, dependencies, risks and opportunities, as this knowledge is key to informing investment decisions. Yet most available indicators are either too limited in their ability to project a future scenario, or are too high-level to meaningfully inform capital allocation. To help bridge […]