Financial institutions are under increasing pressure to understand how companies are managing nature-related impacts, dependencies, risks and opportunities, as this knowledge is key to informing investment decisions.

Yet most available indicators are either too limited in their ability to project a future scenario, or are too high-level to meaningfully inform capital allocation. To help bridge this gap, GIST Impact recently convened an exclusive investor-focused roundtable to explore how decision-makers can deploy actionable forward-looking nature indicators across portfolios, and what role we serve as a data provider to meet this growing need.

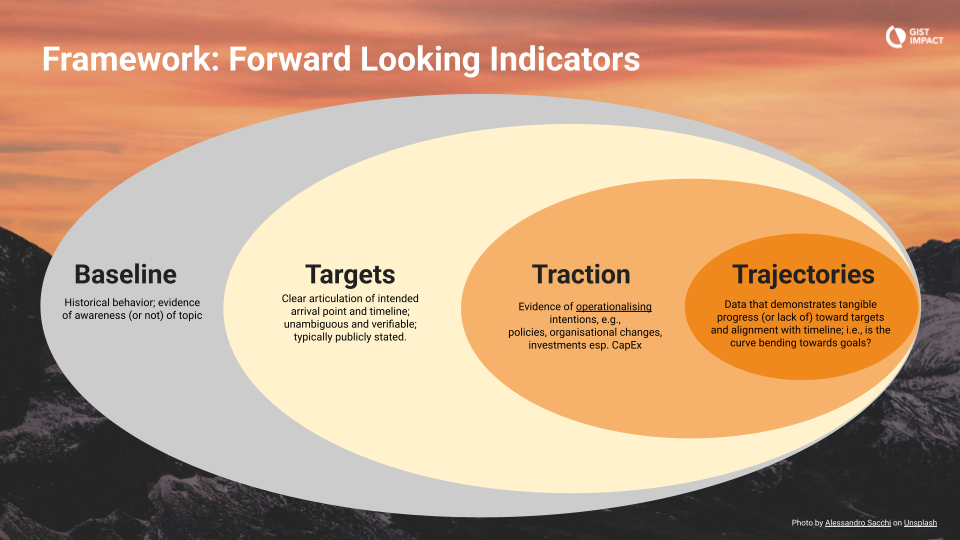

Framework overview

Below is GIST Impact’s high-level framework to categorise different types of indicators that help anticipate a company’s direction and progress on nature and biodiversity. The framework has been informed by our in-house experts, latest market research, and academic input.

The indicator types follow an ‘evidence hierarchy’, described as follows (weakest to strongest):

1. Baseline

- Derived from historic data (location, emissions, water use, land use, etc.).

- The starting point for projections, and weakest signal of intent to change.

2. Targets

- Verifiable commitments and company statements about specific outcomes on defined timelines.

- Indicates deliberate shift from baseline trajectory.

Note: May include cases where targets don’t require operational changes.

3. Traction

- The implementation of tangible organisational changes and investments.

- Operational modifications to align with stated commitments, providing a stronger signal than statements alone.

4. Trajectories

- Verifiable performance data showing progress towards targets, ideally falsifiable and externally verified.

- The strongest evidence of actual trajectory change.

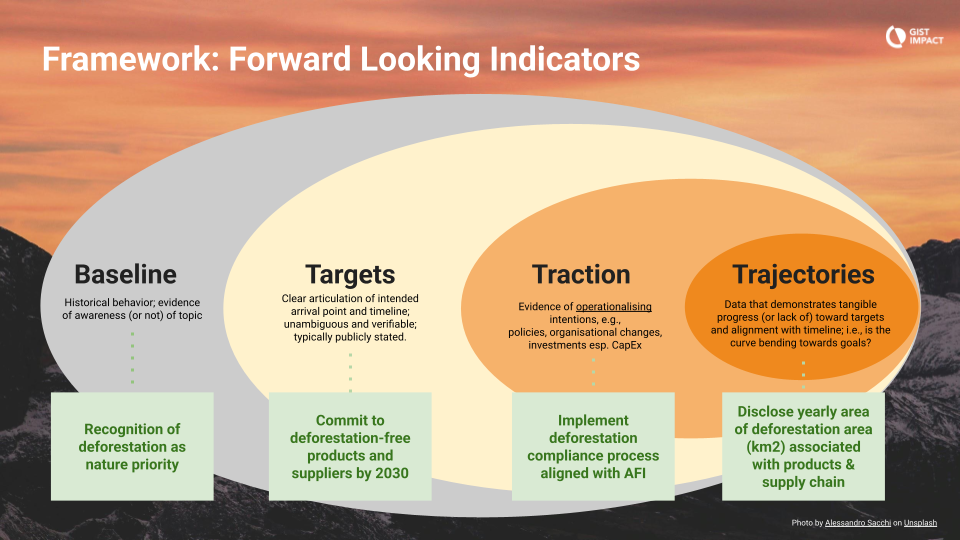

The green boxes below indicate an example of how this framework would apply to deforestation as a thematic category.

As we continue refining this framework and embedding forward-looking nature indicators into our product roadmap, our aim is to catalyse more meaningful conversations across the financial services community.

By sharing our developments early and openly, we hope to equip those working in this space with clearer perspectives on what credible nature metrics should look like, and to ensure that our approach reflects real-world needs.

We encourage investors, academics, and our wider network to engage with us as we advance this work – your insights are essential to shaping the tools and analytics that support effective decision-making on nature and biodiversity.